This chapter reviews period end procedures associated with WIP-based product costing.

Prior to the last day of the period - close all finished status Jobs to auto-reconcile Work in Process

On the final date of the period or earlier, make sure to close all finished Jobs (Jobs > Job Control Panel > Close Jobs). When a job is closed, its WIP balance is brought to zero by adjusting the WIP account up or down to account for any variance between the total job input costs and the total job receipt output costs. The goal should be to Close your Jobs as close to your Finish Date as possible. This will align yourAdjustments - WIP (Cost of Sale) value more closely with your final job receipts to inventory.

When can I correct Job Costs for Finished Jobs?

You have a very limited window of opportunity to correct your Job costs after your have completed your final job receipt and finished a Job. If you recently finished the Job, it is in the same accounting period, and all of the quantities are still in inventory, you can reverse your Job Receipts and correct the Job costs and re-receipt the Job. For almost all other scenarios, it is best to close the Job and post the Adjustments - WIP (Cost of Sales) value to offset the transactions that have already occurred.

No formal accounting period closing process is required

DBA does not have a formal period end closing process. We recommend that you run two processes at period end -- the Financial Cutoff Date and Reconcile Book Values.

Update the Financial Cutoff Date

At each period end, we recommend that you go to the Financial Cutoff Date screen and update the financial cutoff date to prevent financial transactions from being made to the prior period.

Run Reconcile Book Values

At each period end, use the Inventory > Reconcile Book Values screen and perform a GL Batch Posting after running the reconcile routine.

Never make journal entry adjustments to your Inventory account

Never make journal entry adjustments to your Inventory account. This account is self-adjusting and is always fully reconciled with the total inventory value of stock on hand.

Never make journal entry adjustments to your Work in Process account

Never make journal entry adjustments to your Work in Process account. This is a self-adjusting account that is always fully reconciled with underlying job costs.

Update estimated purchase costs

In the BOM > Estimated Purchase Costs screen perform a mass update by default supplier price. Review your estimated cost versus inventory costs to spot any major disrepencies.

Review shop rates

Review the variances for direct labor and shop overhead once per month for an appropriate date range (3 months trailing minimum) in the Shop Rates screen and adjust your shop rates as needed if you sense that an absorbed cost variance is trending in any direction away from actual costs.

Perform a batch cost rollup

Go to BOM > Cost Rollup and perform a batch rollup to update your estimated costs for all of your manufactured items.

Manufacturing Accounts Review

In addition to your standard financial accounting reports, there are several key accounts specific to manufacturing accounting that you should always review. Be aware that the Job transactions and cost of sale adjustments can span multiple accounting periods.

Work in Process (Asset)

Work in Process is at the heart of your manufacturing accounting system. As you perform job transactions in the system your input costs are absorbed into Work in Process. As you receive your finished goods outputs into inventory, the value is moved from Work in Process to Inventory. At Job Close, the value of all job input costs are compared to the value of all Job receipt costs for that Job and any differential is posted to the Adjustments - WIP cost of sale account. This ensures that your overall Cost of Sales (Cost of Goods Sold + Adjustments - WIP) is always correct. Be aware that a Job may span several accounting periods.

Input Costs - Absorbed into WIP

▪Material Costs - Job Issues of Stock Items at Inventory Cost (average cost) of the Item at time of issue

▪Labor and Mfg Overhead - Job Labor hour transactions performed at the Shop Rates as of the time of the transaction (Work Center rates adjusted for Setup Factor, Labor Factor, and Mfg OH Factor)

▪Subcontract Service - Job Issues of Subcontract Service freeform line. The value comes from the PO receipt cost of the linked subcontract PO for the subcontract service.

▪Misc Job Costs - Job Issues of Descriptor lines

Output Receipt Costs - Moves value from Work in Process to Inventory

▪Job Receipt unit cost is averaged with quantities on hand to establish the inventory value for the manufactured item

Job Close - Reconciles the WIP Balance for the Job and balances out the overall cost of sales

▪Compares all Input costs issued to the Job versus Job Receipt Output costs and posts any differential to the Adjustments - WIP cost of sale account.

▪Job WIP is fully reconciled at Job Close automatically

Period End Review

1.Close all finished Jobs on or before the final date of the accounting period in Jobs > Job Control Panel > Close Jobs.

2.Run the Jobs > WIP Value Report

▪Review all details to ensure that all Job costs look like they have reasonable values

▪All Job transactions should be performed real time in the system. Make sure to process any transactions that were not entered real time.

Adjustments - WIP Account (Cost of Sales)

This account is the balancing account for Work in Process discussed above. This account ensures that your overall Cost of Sales is balanced even if you under or over absorb costs to your Job. Small variances are normal and to be expected. If you have chronic issues with high Adjustments - WIP, there are some basic principles to follow that will improve your Job costing.

Period End Review

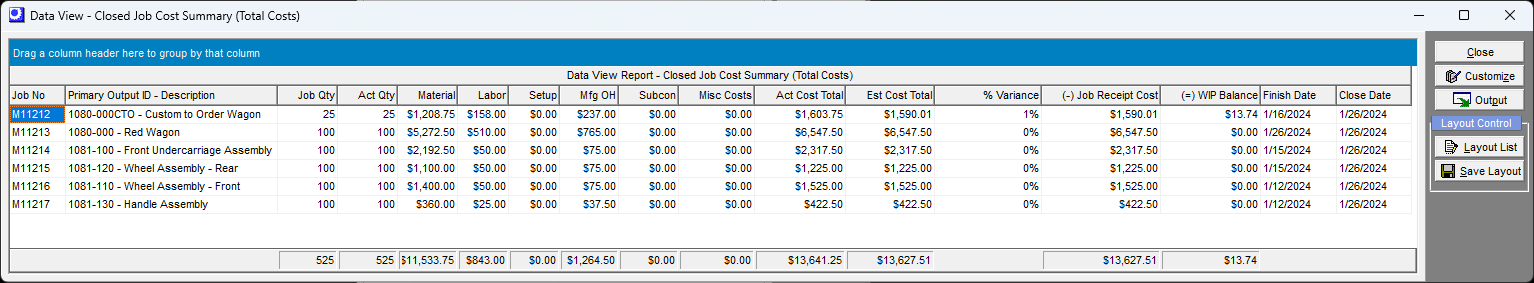

1. Run the Jobs > Data View > Closed Job Cost Summary report to see the details contributing to Adjustments - WIP entries at Job Close.

Best practices to avoid excessive WIP Adjustments

▪Update your supplier prices in MRP PO generation prior to sending out. This will ensure that your PO receipt costs (inventory cost) will be in line with your expectations. Screen Help - MRP Planned POs Grid

▪Update estimated purchase costs by default supplier in BOM > Estimated Purchase Costs and followup with a Batch Cost Rollup. This will ensure that your estimated costs are in line with your latest inventory costs. Training - Product Costing

▪Review your estimated Job costs at time of Job Release. Be aware that all partial Qty Job receipts will be get a suggested unit cost of Est Job Cost. A reasonable estimated job cost up front will prevent most major costing problems. Training - Job Release

▪Perform material issues in real time from the Work Center Schedule screen when the material is needed. Training - Job Issues

▪Perform labor transactions as sequences are completed. Standard hours are recommended for improved throughput and costing. Training - Job Labor

▪Before performing the Final Receipt of a Job, make sure all of the status indicators are green and the WIP Balance value is reasonable. Training - Job Receipts

▪Close your Jobs on the same day as your Final Receipt. This will reconcile the WIP for the Job and ensure that your overall Cost of Sales (Cost of Goods Sold + Adjustments - WIP) is correct. Training - Job Close

Inventory (Asset)

Inventory value is always an average cost based on the value of PO Receipt costs and Job Receipt costs averaging with existing quantities on hand. Inventory Value

Period End Review

1.On the final day the period or before, use the Inventory > Reconcile Book Values screen and perform a GL Batch Posting after running the reconcile routine.

2.Run the Inventory > Reports > Inventory Value report and go to the final page to review the total value. Make sure that this value ties down to the GL Inventory account value. Review your items and ensure that there are not any obvious discrepancies between your Estimated Costs and Inventory Costs.

Job reopen to correct costs should be used with caution

You have a very limited window of opportunity to correct your Job costs after your have completed your final job receipt and Finished/Closed a Job. If you recently finished the Job, it is in the same accounting period, and all of the quantities are still in inventory, you can Reopen the Job. reverse your Job Receipts and correct the Job costs (Job Issues and/or Job Labor) and re-receipt the Job. For almost all other scenarios, it is best to leave the Job Closed. From an accounting standpoint, the Adjustments - WIP (Cost of Sales) posting at Job Close has already offset your potential costing imbalances between your job inputs and job outputs receipted.

Use Inventory > Change Inventory Costs to change the inventory value for an Item

The inventory account must always tie down to the underlying transactions in the system. You cannot make journal entries to the Inventory account. If you need to correct an inventory value for an item, use the Change Inventory Cost screen. This routine will post an entry to the Adjustments - Inventory Cost of Sales account.

Adjustments - Inventory or Adjustments - COGs (Cost of Sales)

This account is used for Stock Adjustments (STKADJ), Stock Counts (COUNT) , Change Book Value (VALCHG) Change Inventory Costs (COSTCHG) inventory transactions.

Period End Review

1.Run the Inventory > Data Views > Inventory Transactions Detail view for the period and filter for the STKADJ, COUNT, VALCHG, and COSTCHG transaction type and group by transaction type.

Excessive use of Stock Adjustments or Stock Counts is a sign of bad process

If you are seeing a large number of transactions for either STKADJ or COUNT, you should review the accuracy of your Bills of Material or possibly whether you are avoiding the required workflow for your transactons.

Frequent need for Change of Inventory Costs may indicate poor costing fundamentals

Review the steps in Achieving Realistic COGs

Received Not Invoiced (Liability)

The Received Not Invoiced account stores the credit offset entry that is made when PO Lines are received. Once the line is invoiced in the PO Invoice matching process, this clearing account will get reduced. The Received not Invoiced value for an item is zeroed out when a PO line is fully invoiced and the line is closed.

Adjustments - Received not Invoiced (Cost of Sales)

When a PO line is closed, any difference between total receipt costs and total invoice costs is posted to the Adjustments - Received not Invoiced account. PO Lines are automatically closed in the PO Invoice screen when the quantity and values are fully matched. Lines can also be manually closed in the PO detail line. PO Line close ensures that the Received Not Invoiced account is always zeroed out for a closed PO line.

Period End Review

1.Run the Purch > Reports > Received not Invoiced report and make sure to create PO Invoices in a timely manner. If the PO is fully invoiced, you may need to manually close a line in the PO details screen to drop the item from this report and to reconcile the Received not Invoiced account.

2.Run the Purch > Data Views > PO Lines Summary for Closed POs to get a good overview of receipt costs versus invoice costs.

Excessive values in Adjustments Received not Invoiced is a red flag

If you consistently have Adjustments Received not Invoiced, you are likely not verifying your prices when you send out your Purchase Orders. Since inventory value is calculated at time of PO Receipts it is imperative that you have accurate prices on your POs when you send them to your supplier.

Overall Cost of Sales

The overall Cost of Sales in DBA is self correcting. For example, if you receipted more value into inventory than your actual job costs issued to a Job. The inventory value is elevated. When the item is sold, the Cost of Goods Sold would be a bit overstated. However, when the Job is closed, there will be an offsetting Adjustments - WIP made. The overall cost of sales (Cost of Goods Sold + Adjustments - WIP) will be correct over the entire course of the Job. The challenge comes when viewing an accounting period it is possible that some entries are in one period and the correcting entries are in another period. It is important when looking at a given single period that you also look at the year to date view so you can get a better understanding of the overall Cost of Sales (Cost of Goods Sold + all Adjustment Accounts - Adjustments - WIP, Adjustments - Inventory, Adjustments - Received not Invoiced)

Overall Cost of Sales

Cost of Goods Sold

Adjustments - WIP

Adjustments - Inventory or Adjustments - COGs

Adjustments - Received not Invoiced

Period End Review of Cost of Sales

1. Run the GL > Analysis > Profit and Loss Accounts for a range of your Cost of Sales accounts and create a column for the Accounting Period and also create a column for Year to Date. The following screenshot is for the June 2024 period and also YTD 2024 (01/01/2024 to 06/30/2024).

Absorbed Labor Costs - Cost of Sales

Job labor costs within this date range are posted to the Absorbed Labor account based on the shop labor rate applied to work center hourly rates. The objective of the hourly shop labor rate is for total Absorbed Labor to roughly offset the adjacent actual direct labor cost accounts, which neutralizes any effect on cost of sales. Job labor costs get absorbed into item inventory values with job receipts and ultimately affect cost of sales through cost of goods sold when items are invoiced.

If you are using the Financial Transfer it is imperative that you are able to isolate your direct costs for your production workers. You want to compare your direct payroll costs for your production workers with your absorbed labor costs Review the setup instructions if your financial accounting GL is not set up properly.

Absorption Costing - Cost of Sales Setup

Absorption Costing - Cost of Sales Setup

Quarterly Review of Shop Rate for Labor

We recommend that at least quarterly that you update your Shop Rates to ensure that your absorbed costs more closely approximate your direct costs for your production workers

Absorption Costing - Shop Rates

Absorption Costing - Shop Rates

Absorbed Mfg Overhead Costs - Cost of Sales

Job overhead costs within this date range are posted to the Absorbed Factory Overhead account based on the shop overhead rate applied to work center hourly rates. The objective of the hourly shop overhead rate is for Absorbed Mfg Overhead to roughly offset the adjacent actual overhead cost accounts, which neutralizes any effect on cost of sales. Job overhead costs get absorbed into item inventory values with job receipts and ultimately affect cost of sales through cost of goods sold when items are invoiced.

If you are using the Financial Transfer it is imperative that you are able to isolate our overhead costs. You will compare your overhead costs with your absorbed factory overhead costs. Review the setup instructions if your GL is not set up properly with your overhead accounts set up as cost of sale accounts.

Absorption Costing - Cost of Sales Setup

Absorption Costing - Cost of Sales Setup

Quarterly Review of Shop Rate for Mfg Overhead

We recommend that at least quarterly that you update your Shop Rates to ensure that your absorbed costs more closely approximate your direct overhead costs.

Absorption Costing - Shop Rates

Absorption Costing - Shop Rates

Absorbed Subcontract Cost - Cost of Sales

The Absorbed Subcontract Cost account is a clearing account that should always have a zero balance on the Income Statement. When you receipt your PO for your subcontract services freeform line on the PO, the value debits the Absorbed Subcontract Cost account and then an immediate automatic Job issue is performed against the subcontract service ID freeform job line that credits the Absorbed Subcontract Cost account and debits Work in Process. The net effect is that the Absorbed Subcontract Cost is zeroed and the subcontract cost is absorbed into Work in Process value for the Job.