(BOM – Shop Rates)

Links:

Screen Details - Financial Transfer Accounting Configuration

Screen Details - Financial Transfer Accounting Configuration

Screen Details - Legacy Financials Accounting Configuration

Screen Details - Legacy Financials Accounting Configuration

Overview

Use the Shop Rates screen to update an hourly shop rate for direct labor and an hourly shop rate for manufacturing overhead. These shop rates are applied to work center hourly rates, where they can be factored up or down for exceptions.

The overall goal in your Financial Accounting system is to isolate your production labor costs and your manufacturing overhead costs for a period of time. Those values will be divided by the DBA production hours (adjusted for Work Center factors) reported for the same period of time to come up with a Labor and Mfg Overhead shop rate.

What is the purpose of the Shop Rates screen?

The purpose of the Shop Rates screen is to maintain a single shop hourly rate for direct labor and a single shop hourly rate for manufacturing overhead. The hourly shop rates get applied to work center hourly rates where they can be factored up or down for exceptions.

How are shop rates determined?

The two shop rates are calculated using the following formulas from a recent date range of actual costs and reported labor hours. This enables future job labor transactions to be costed at hourly labor and overhead rates that fully absorb your actual costs into work in process, which ultimately flows into inventory value and cost of goods sold.

Actual Direct Labor Costs / Reported Job Hours = Shop Labor Rate

Actual Mfg Overhead Costs / Reported Job Hours = Ship Overhead Rate

What are direct labor costs?

Direct labor costs are the actual payroll costs associated with production worker employees, including benefits, taxes, and wages, as well as their share of workmans compensation insurance. Contract worker costs are also direct labor costs.

NOTE: Do not include payroll costs for manager, supervisor, shipping, receiving, warehouse, inspection, maintenance, and development employees, which are considered to be indirect labor costs.

What is the Absorbed Labor account?

The Absorbed Labor cost account gets updated by job labor transactions and is a contra-account that offsets actual direct labor costs over a given period of time. Absorbed Labor ideally washes out with actual direct labor costs so that there is no effect on current net income. Instead, absorbed labor costs flow from work in process into item inventory costs and only affect net income in the form of Cost of Goods Sold when items are invoiced.

The objective of the Shop Rates screen is to calculate a shop labor rate that enables Absorbed Labor to wash out with actual direct labor costs.

What is manufacturing overhead?

Manufacturing overhead includes all the indirect costs associated with the manufacturing process, including the factory’s share of rent, utilities, maintenance, supplies, taxes, insurance, and depreciation, as well as payroll benefits, taxes, and wages for indirect labor, which includes shop manager, supervisor, shipping, receiving, warehouse, inspection, and maintenance employees.

NOTE: Manufacturing overhead should not include selling, general and administrative (SG&A) expenses.

What is the Absorbed Mfg Overhead account?

The Absorbed Mfg Overhead cost account gets updated by job labor transactions and is a contra-account that offsets actual manufacturing overhead costs over a given period of time. Absorbed Mfg Overhead ideally washes out with actual manufacturing overhead costs so that there is no effect on current net income. Instead, absorbed manufacturing overhead costs flow from work in process into item inventory costs and only affect net income in the form of Cost of Goods Sold when items are invoiced.

The objective of the Shop Rates screen is to calculate a shop overhead rate that enables Absorbed Mfg Overhead to wash out with actual direct labor costs.

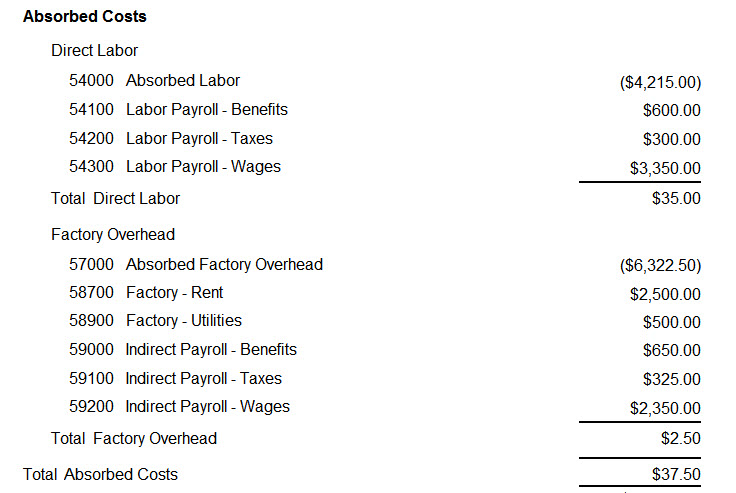

Income statement example

It may help you conceptualize how absorbed costs wash out with actual costs by reviewing the following Cost of Sales - Absorbed Costs section of a sample income statement.

NOTE: Keep in mind that this is simplified sample data and that in a real company many more actual cost accounts will be displayed, especially in regards to manufacturing overhead costs.

Direct Labor Section

Take note of the Direct Labor section. Job labor costs within this date range are posted to the Absorbed Labor account based on the shop labor rate applied to work center hourly rates. The objective of the hourly shop labor rate is for total Absorbed Labor to roughly offset the adjacent actual direct labor cost accounts, which neutralizes any effect on cost of sales. Job labor costs get absorbed into item inventory values with job receipts and ultimately affect cost of sales through cost of goods sold when items are invoiced.

Factory Overhead Section

Take note of the Factory Overhead section. Job overhead costs within this date range are posted to the Absorbed Factory Overhead account based on the shop overhead rate applied to work center hourly rates. The objective of the hourly shop overhead rate is for Absorbed Mfg Overhead to roughly offset the adjacent actual overhead cost accounts, which neutralizes any effect on cost of sales. Job overhead costs get absorbed into item inventory values with job receipts and ultimately affect cost of sales through cost of goods sold when items are invoiced.

The recent past is used to predict the near future

Shop rates are calculated from recent past data, which provides a reasonable prediction of future hourly rates because the near future is likely to resemble the recent past. By default the screen displays reported job hours for the past three complete months. When you use the financial transfer accounting configuration, you will manually enter total direct labor costs and total manufacturing overhead costs from your outside general ledger for the same time period.

We recommend quarterly updating

We recommend updating shop rates once a quarter. If you recently implemented DBA and are still refining your numbers, you may wish to update shop rates more frequently, such as each accounting period, until they stabilize.

Variances are normal and expected

Because hourly shop rates are a prediction of future costs and hours, there will always be an accounting variance between absorbed costs and your actual labor and overhead costs. Such variances are normal and expected and are automatically handled by the accounting system.

Perform a BOM Cost Rollup after any change to Shop Rates

After any change to your Shop Rates, you must perform a BOM > Cost Rollup to reflect your new estimated costs for Labor and Mfg Overhead in all of your manufactured items.