This chapter explains how inventory value affects work in process and how it is properly established and maintained.

Inventory value is an average cost based on Receipt transaction costs (PO Receipts and Job Receipts)

Inventory value is always an average cost based on the value of PO Receipt costs and Job Receipt costs averaging with existing quantities on hand.

Item inventory values directly affect work in process

Item inventory values directly affect work in process because raw materials, purchased components, and subassemblies are issued to jobs at their unit Inventory Cost, which is an average cost. It is therefore vitally important that each item is given a realistic unit cost at time of receipt to properly update its unit Inventory Cost.

Assign all PO lines a realistic supplier price

Purchased items are received to inventory in real time at the PO unit cost, which is translated from the supplier price. Supplier invoice matching, which often occurs well after items are received and issued to jobs, does not update PO costs after-the-fact. It is therefore essential that all PO lines are assigned a supplier price at time of PO generation to establish a realistic inventory cost.

Make sure all status indicators are Green prior to Final Receipt and WIP Balance value is reasonable

When finished items are received to inventory in the Job Receipts screen, make sure that you have completed all job transactions and are in green light status for status indicators for Sequence, Hours, Issues, and Subcon. You should always perform your material issues in real time and report labor as you complete routing sequences. Do not attempt to report labor hours after final receipt.

Receive finished items at a realistic cost

When finished items are received to inventory in the Job Receipts screen, always make sure the unit cost is realistic, meaning that it is within acceptable range to the estimated job cost and is not affected by an obvious costing error.

Never make journal entry adjustments to your Inventory account

Never make journal entry adjustments to your Inventory account. This is a self-adjusting account that is always fully reconciled with the total inventory value of stock on hand. It is essential that the main Inventory account always tie down to the underlying inventory transactions in the system. Two screens can be used to adjust the Inventory account balance:

Change Inventory Cost

The Change Inventory Cost screen is used to change an item’s Inventory Cost. This is used to correct the value of stock on hand when an obvious costing error has been discovered after receipt transactions have been made.

NOTE: This screen only corrects the value of stock on hand and does not correct any past transaction costs.

Reconcile Book Values

The Reconcile Book Values screen is used to adjust total inventory value to account for decimal rounding discrepancies between inventory transaction costs, which are made with five decimal places, and GL posting amounts, which are made with two decimal places. There is also a potential book value differential when you reverse a PO Receipt or Job Receipt and the reversal transaction is performed at a different value than the inventory cost for the item. After the reversal transaction occurs, the system will re-average the remaining quantity on hand to calculate a new average cost. If there is not any qty remaining after the reversal or if the remaining quantity re-calculation requires a negative inventory value, then there can be a book value discrepancy that will need to be reconciled.

If you have been making journal entries to your Inventory account

If you have been making journal entries to your Inventory account, stop doing so from this point forward. Run the Inventory Value report to determine your actual inventory value and compare that value with your current Inventory account balance.

If the report value differs from the account balance, calculate the difference and make the following one-time journal entry for the difference amount to get the Inventory account correctly established so that it can be self-adjusting from this point forward.

If the report value is greater than the account balance:

Debit 12000 Inventory

Credit 53100 Adjustments – Inventory

If the report value is less than the account balance:

Debit 53100 Adjustments – Inventory

Credit 12000 Inventory

After making this one-time journal entry, cease making any journal entry adjustments to the Inventory account from this point forward.

All inventory transactions are performed at today's date

All inventory transactions are performed as of today's date, including Stock Count posting. You cannot backdate the value into the primary Inventory GL account. If you must move the value into a prior period via journal entry, you must create a special GL Asset Account for this purpose. The following two articles present some info on backdating inventory transactions.

KB - Backdating Inventory Transactions

KB - How do I backdate transactions into a prior accounting period?

Obsolete Inventory - never make journal entries directly to your Inventory GL account

GAAP requires that all obsolete inventory be written off at the time it's determined obsolete. We recommend that you consult with your accountant on how to best handle your company's strategy. Here are links to a couple of articles that highlight some of the tools available in DBA to manage obsolete inventory items.

KB - How to report on non-moving inventory

KB - How to deal with obsolete inventory

Can I get a break out of material, labor, manufacturing overhead in my Inventory GL account?

DBA is an absorbed work in process manufacturing cost system and does not specifically break out the individual cost elements in your Inventory GL account. There is a self correcting relationship between your asset accounts of Work in Process and Inventory and your Cost of Sale accounts that is always going on. Do not attempt to make journal entries to your Inventory account to segment the value by cost type as this will interfere with the self-balancing design of our system.

Work in Process Accounting Benefits

▪Inventory and Work in Process are always up to date and will tie down to transactions in the system

▪Work in Process is auto reconciled at Job Close

oNo month end closing procedures or journal entries are needed

oYou never have to perform stock counts for Work in Process

oThe Adjustments- WIP entry will ensure that your overall Cost of Sales is correct

▪You can freely update your estimated costs via Cost Rollup without impacting GL Inventory value

▪Eliminates the need for associating specific purchases or payroll costs to specific jobs

Of course, we do fully absorb costs (material, labor, mfg overhead, miscellaneous and subcontract costs) into your Work in Process and Inventory asset account and recognize these as Cost of Goods Sold when the product is ultimately invoiced to the customer. You have several tools available to help you review how your absorbed costs contribute to your inventory value and cost of sales:

1. GL > Reports > Income Statement > Cost of Sales or GL > Analysis > Profit and Loss Accounts (filtered to Cost of Sales range)

To get an approximate idea of your absorbed cost contributions to your overall Cost of Sales you can use the income statement cost of sales section. We recommend that you run the report for the year to date to capture all of the potential indirect cost of sales account activity. You can compare your absorbed costs versus your total cost of sales (Direct Costs and Indirect Costs $134700 + $315 = $13515). In the example below, Absorbed Labor represents approximately 5% of the Cost of Sales ($6744/$13515) and Absorbed Manufacturing Overhead represents approximately 7.5% of the Cost of Sales. This would leave the approximately 87.5% of the value for Material.

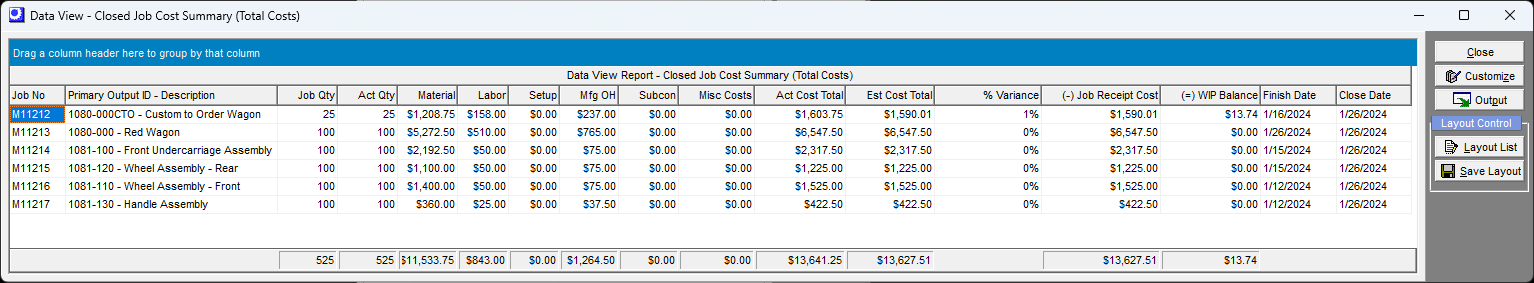

2. Jobs > Data Views > Closed Job Cost Summary

This is an excellent report to see the various absorbed costs versus receipt costs for your manufactured items.

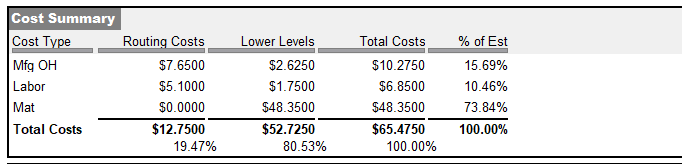

3. BOM > Reports > Costed BOM Report

For an individual item, you can get the percentage contribution of the cost elements to that item's estimated costs. If your estimated costs are fairly close to inventory cost for that item you can use these percentages to analyze your on hand stock value for that item.