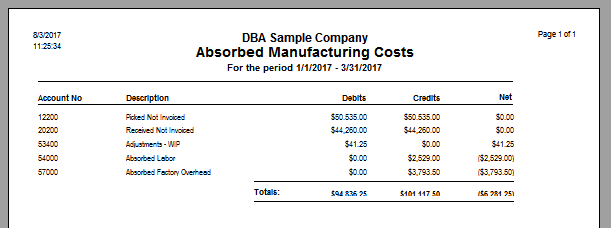

(GL – Reports – Absorbed Mfg Costs)

Legacy Report

This is a legacy report. In prior versions of the product, we allowed an option to consolidate all of your absorbed manufacturing costs into a single catch all expense account in response the reluctance of many customers to reorganize their cost of sales accounts and to add several new accounts to their financial accounting general ledger. Experience has shown that it is far better to add all of the accounts to your financial general ledger and re-organize your cost of sales accounts to mimic the structure of the DBA standard chart of accounts

This report is only visible when the Accounting Configuration is set to the Financial Transfer option, which enables DBA to be used with an outside accounting system.

The Absorbed Mfg Costs account is a “catch all” expense account in your outside system that represents a blend of the following DBA accounts.

12200 |

Picked Not Invoiced |

20200 |

Received Not Invoiced |

51100 |

Accrued Service Labor |

52200 |

Accrued Misc Sales Cost |

52500 |

PO Shipping Cost |

53100 |

Adjustments - Inventory |

53300 |

Adjustments - Recd Not Invoiced |

53400 |

Adjustments - WIP |

54000 |

Absorbed Labor |

55000 |

Absorbed Subcontract Cost |

56000 |

Absorbed Misc Job Cost |

57000 |

Absorbed Factory Overhead |

61360 |

Misc Purchases |

61480 |

Purchase Tax |

At period end this account will have a credit balance that roughly offsets your actual direct labor and factory overhead costs. This serves to absorb those costs into your inventory.

This report provides a breakout of the Absorbed Mfg Costs account total by the 14 DBA accounts that comprise it. You can run the report for any range of accounting periods.