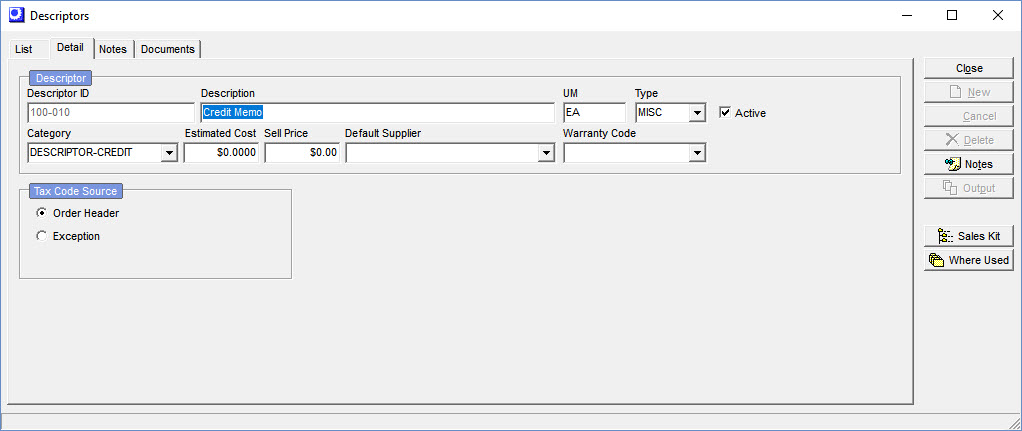

(Inventory – Descriptors - Detail Tab)

Uses of Descriptors

Never use Descriptors to represent any physical items used in BOMs or jobs, even when such items are never kept in stock. Always use Stock Items to represent raw material or components.

Descriptors are used for the following purposes:

Credit Memos

Credit memos are required from time to time to make adjustments to customer account balances for product returns, price adjustments, write-offs to bad debt, and other such things. A credit memo in DBA is simply an invoice with a negative total amount. Credit memo line items are descriptors with negative prices. GL posting is determined by mapping the descriptor’s item category to the appropriate sales account in the Account Assignments screen.

Labor Charges

If you charge customers for labor on invoices, labor is set up as a descriptor and is entered as a sales order line item. You might set up several labor descriptors, each with a different base price, if you charge different rates for different services.

Miscellaneous Charges

Any other charges that might be included in your invoices, whether they are for shipping, engineering fees, permits, etc., can be set with descriptors and prices. Any price can be overridden at the time of sales order entry.

Miscellaneous Purchases

If you use purchase orders for non-job, non-inventory purposes – for miscellaneous items such as office supplies, shop supplies, furniture, equipment, etc. – you can represent each category of these purchases with a descriptor. These descriptors can be assigned to GL accounts in the Purchasing – Exceptions tab in the Account Assignments screen. When entering a PO line item, you can modify the category descriptor with a specific description for the item being purchased.

Sales Kits

A “sales kit” is a set of items that gets copied into a sales order along with the sales kit parent item, which is represented by a descriptor. Sales kits are created in the Inventory – Sales Kits screen.

Descriptor

Descriptor ID (Required)

This is an up to 20-character alphanumeric code used to identify the descriptor.

Description (Required)

This is an up to 50-character description that accompanies the descriptor ID on screens and reports.

UM (Required)

This is the descriptor’s unit of measure (EA, HR, etc.), which can be up to 8-characters.

Type (Required)

Select one of these three descriptor types:

LABOR

This type is used for:

| • | Service Labor Charges (Sales Orders) |

MISC

This type is used for:

| • | Customer Credit Memos (Sales Orders) |

| • | Miscellaneous Charges (Sales Orders) |

| • | Miscellaneous Cost (Bills of Material) |

| • | Miscellaneous Purchases (Purchase Orders) |

| • | Options Placeholder (Bills of Material) |

| • | Sales Kit Parents (Sales Kits) |

| • | Supplier Credit Memos (Purchase Orders) |

SHIP

This type is used for:

| • | Line Item Shipping Charges (Sales Orders, Purchase Orders) |

Category (Required)

Each descriptor must be assigned to an item category. Item categories are used to organize your stock items and descriptors into groups for reporting and GL posting purposes.

GL Posting Exceptions

Sales - For sales posting to a specific GL Account you can map a Sales Exception by Item Category in the GL - General Ledger Setup - Account Assignments - Sales - Exceptions tab.

Purchasing - For purchasing exceptions you map an exception directly to the specific Descriptor ID in the GL - General Ledger Setup - Account Assignments - Purchasing - Exceptions tab.

Estimated Cost

Purchase Descriptors - With miscellaneous purchases, this is used as the unit cost in PO lines.

Sales Descriptors - We recommend that you set the Estimated Cost to zero for descriptors used in sales orders. If you do enter a value for estimated cost for labor, miscellaneous, or shipping charges, this cost is used as the invoice cost of sales.

Kitset Descriptors - Always set the Estimated Cost to zero. The cost of goods sold will come from the costs of the kit components.

BOM Descriptors - If you use descriptor components in BOMs, the Estimated Cost field will be used in Cost Rollups for Misc Job costs.

Sell Price

The sell price is used in sales orders for labor charges or miscellaneous charges.

Default Supplier

This is the preferred supplier for miscellaneous purchases. Leave blank for all other descriptor types.

Tax Code Source

These settings determine the source of the tax code against sales order and purchase order lines for this descriptor.

Order Header

When you select this option, the tax code specified in the sales order or purchase order header determines the source of the sales order or purchase order line’s tax code for this descriptor.

Exception

Select this option if this descriptor is to receive an exception tax code that overrides the sales order or purchase order header tax code. A Tax Code field becomes visible to the right. Select a tax code from the lookup. In general, a tax code exception is designated when the descriptor is non-taxable, in which case a non-taxable tax code should be selected. Another tax code exception is when the descriptor bears a special tax rate, such as an excise tax.

Tax Group

This checkbox is only visible when the Tax Group Matrix option is selected in the Tax Defaults screen. Tax groups enable you to designate exception tax codes at the line item level that only apply to certain destinations or sources. A Tax Group field becomes visible to the right. Select a tax group from the lookup. When a descriptor assigned to a tax group encounters a customer or supplier that is also assigned to a tax group, the two tax groups are matched in the tax group matrix to determine the tax code that gets used in the sales order or purchase order line.

Warranty Code

If there is a warranty code associated with this descriptor, select one from the lookup.