This chapter explains how to set up the Financial Transfer Defaults screen.

Create a special non-inventory (non tax) Item in your Financial Accounting system

Your AR Voucher Invoices will be created in your outside accounting system using this special Item ID that you must create. In this step you will create the non-inventory/non-tax item in your accounting system and cross reference the Item ID in the Financial Transfer Defaults screen in DBA.

AR Invoice Line Item ID

In your outside accounting system, create a special item (part number of your choice) and enter its item ID (part number) in the Financial Transfer Defaults screen for inclusion in the AR Voucher Transfer screen output.

Item Type (Non-Inventory)

The item must be designated as a non-inventory item.

Description

Give the item a description of AR Invoice Transfer or the description of your choosing.

Sales Account - assign to the AR Invoice Transfer clearing account

Assign the item sales account to your AR Invoice Transfer clearing account in your accounting system GL.

NOTE: If you are required to designate a COGS account, use your AR Invoice Transfer account as well.

Tax (Non-Taxable)

Designate this item as non-taxable or assign it to a non-taxable tax code so that tax does not get added when the voucher is imported. Tax is already processed in the DBA invoice and is not to be itemized in the AR invoice.

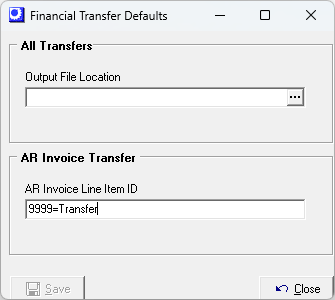

Screen Details

Output File Location

Use this setting to designate a destination folder for your transfer files. If you leave this blank, your transfer files will be saved by default to your ProgramFiles\DBAManufacturing folder.

AR Invoice Line Item ID

This is the non-inventory Item ID number that you created in your financial accounting system. This Line Item ID will flow through to the Transfer > AR Voucher Transfer screen. When you enter the sales Invoice in your outside accounting system, you will use this Item ID with a Qty of 1 for the single line voucher amount.

AR Voucher Transfer Process in Outside Accounting Program

•Create an invoice for the special non-stock item/non-tax item that you created in your outside accounting system as part of the financial transfer setup. Do not attempt to include a tax code or tax detail in your financial accounting system.

•The non-stock item will be setup to credit the AR Invoice Transfer (Asset - 11150) account instead of a Sales account. The invoice debit will use your existing Accounts Receivable account.

•The debit values to the 11150 AR Invoice Transfer created during the DBA invoice process will be posted to the outside system as part of the Transfer > GL Summary Transfer.

•The net effect is that the debit to the AR Invoice Transfer from the DBA invoice process will offset the credit for the AR Invoice Transfer voucher in your outside accounting system, thus leaving Accounts Receivable in your outside system for normal payment collection.

Line Item Sale - special non-stock item in outside system

Debit |

Accounts Receivable in outside system |

Credit |

AR Invoice Transfer (Asset - 11150) |