(Tax – Tax Codes)

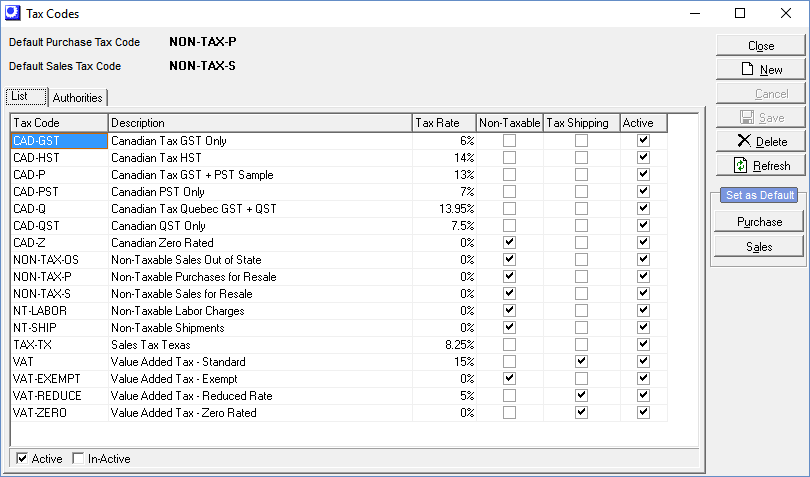

Tax Codes are designated within sales order and purchase order line items to determine the tax rate that gets applied. Each tax code can be comprised of multiple Tax Authorities, each of which contributes its own share of the overall tax rate.

Link:

Screen Details

Tax Code

The tax code can be up to 10-characters in length.

Description

Enter an up to 50-character description that helps identify the tax code on screens, lookups, and reports.

Tax Rate

This is the total tax rate (read only) that will be charged to line items assigned to this tax code. This field is for reference only and is the sum of the Net % amounts of the tax authorities that comprise this tax code. The tax rate entries are made in the Authorities tab and not directly in the opening list.

Non-Taxable

Select this checkbox to designate this as a “non-taxable” tax code, which forces the tax rate to zero. Sales associated with this tax code are flagged as non-taxable and can be filtered from taxable sales on data views and reports.

Tax Shipping

Select this checkbox if tax is to be applied to shipping charges. If selected, the Tax field becomes visible next to the shipping charges entry field in the sales order Shipping screen and tax will automatically be applied to the shipping charges entered.

Select as Default Buttons

You can select one default tax code for purchases and one for sales by selecting a tax code and clicking the Purchase or Sales button. When you do so, you will see the result reflected in the Default Purchase Tax Code and Default Sales Tax Code fields in the upper panel of the screen.

These default tax codes are applied to purchase orders and sales orders whenever a customer or supplier has not been assigned to a tax code Exception.

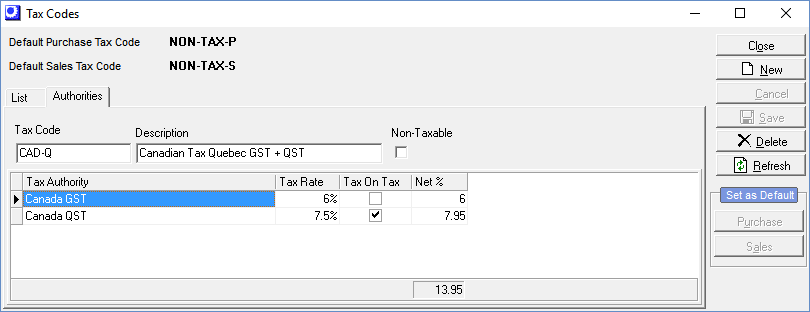

Authorities Tab

Tax Authority

Select each of the tax authorities that comprise this tax code from the lookup in this field.

Tax Rate

Enter the actual tax rate charged by the tax authority in this field.

Tax on Tax

In some situations, a tax authority charges tax not only on the line item net amount, but also on other tax applied to the line item. If you select the Tax on Tax checkbox, its tax rate will be applied to the tax rates of all the tax authorities that precede it on the screen, the result of which is reflected in its Net % amount.

Net %

This is the actual net tax rate (read only) that will be charged by this tax authority, adjusted upwards from the nominal tax rate if the Tax on Tax checkbox is selected.