(Jobs – Jobs Setup – Job Cost Defaults)

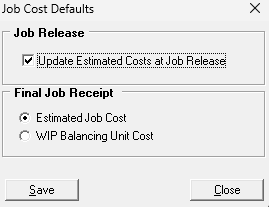

Use this screen to establish settings for updating Estimated Costs at Job Release and your Final Job Receipt suggested unit cost preference.

Link:

Startup Guide - Job Cost Defaults

Startup Guide - Job Cost Defaults

Job Receipt Overview

Job Receipt costs establish inventory value

Inventory value for your manufactured items is established by the Job Receipt cost. The job receipt can be always be performed at the Estimated Job Cost or you can choose to have a final receipt balancing cost that leaves zero net WIP. Regardless of the method, the receipt cost will be averaged with any quantities and value on hand to come up with your inventory value.

DBA is a Work in Process accounting system

As you issue materials, subcontract services and labor to a job it accumulates in Work in Process. When you receipt the finished goods output into inventory it will debit Inventory and credit Work in Process. Your final receipt cost in the Job Receipt screen can either be at Estimated Job Cost or, if your input costs are completely reported, you can use the final receipt WIP Balancing Unit Cost to zero out net WIP.

When the Job is Closed, DBA will reconcile all of your input costs (material issues and labor) versus your job receipt output values and post the difference to WIP Adjustments. This ensures that your Inventory and Work in Process accounts are always up to date.

Screen Details

Job Release

You can check this box to update your Estimated Costs at Job Release (Recommended). If checked, at Job Release it will update the material costs of all components with the current Item Estimated Cost and it will update all of your Work Center shop rates for Setup, Labor, and Mfg Overhead in your Job Routings.

Final Job Receipt

At time of Final Job Receipt, you have two options on how to handle the suggested Final Receipt unit cost:

Estimated Job Cost

With this method all Job Receipts suggested unit costs are at the Estimated Job Cost. When the Job is Closed, the system will compare all of the input costs (material job issues and labor transaction costs) versus the value of the total Job Receipt output costs and it will post any difference to your WIP Adjustments account. Estimated Job Cost preference combined with Standard hour sequence routing completions will approximate the functions of a standard costing system.

WIP Balancing Unit Cost

With this Final Job Receipt method, partial receipts are made at the Estimated Job Cost and, if your input costs are completely reported, the final receipt is given a suggested unit cost that exactly balances all input costs with the total receipt output costs, leaving a zero net WIP balance.

Final Receipt Balancing Cost Overview

•All partial receipts are performed at Estimated Job Cost. Partial receipts can lead to a very large and unexpected final receipt balancing cost for the final receipt. You may want to limit progressive receipts if you choose the WIP Balancing Unit Cost option for final receipt.

•You must be committed to having all material and labor accurately reported before you perform your final receipt. A balancing cost will only be suggested if you a have green light for your Sequence Status, Issues Status, Subcon Status, and Labor Status indicators in the Job Receipt screen. If you do not have all statuses in green light condition, the suggested unit cost will be Estimated Job Cost.

•Use common sense judgment and realize that a suggested unit cost is only a suggestion. Do not blindly receipt an output value that is not in line with your expectation or inventory value.

DBA Tips

Review your Estimated Job Costs at Job Release

An essential step of Job Release is to review the Job Cost Inquiry from the Job Control Panel > Job Release screen. Always make sure that your Estimated Job Costs are reasonable. If you see issues with your estimated material costs or labor costs, do not release the Job to production. Correct the costs in the BOM > Estimated Purchase Costs screen and then perform a Batch Cost Rollup. We cannot emphasize strongly enough how important your Estimated Job Costs are at ultimately establishing your inventory costs and cost of goods sold. A little diligence prior to Job Release will avoid a lot of headache down the road.

Only perform Final Job Receipts when all statuses are Green

You should always have all material issues, labor transactions, and subcontract transactions completed prior to final receipt of your output. You should always be performing your material issues in real time and report labor as you complete sequences. The practice of entering labor hours after final job receipt should be avoided.

Special Warning Regarding Actual Hours Routing Sequences

Our experience has shown that it is very difficult to perform actual hours in most manufacturing environments. The reality of most shops are that once an item is finished it is shipped out as soon as possible regardless of whether all of the costing information has been submitted. It is very easy to make errors or omissions in labor entry that can have a very consequential effect on your cost of sales accounts and make your income statement a challenge to interpret. Since the product is likely already out the door, there is not an opportunity to fix the costs after the fact. We strongly recommend Standard hours completions on Routings for most companies.

Use common sense judgment at Job Receipt

The Job Receipt value establishes your inventory cost and cost of goods sold for the item's that you manufacture. Do not just blindly accept the suggested unit cost. Make sure that you always review that the unit cost is reasonable and in line with your expectation. Stop and correct the Job details immediately before receipting the output. You will have very limited ability to correct costs once the Job is finished and the product has been shipped.

Jobs must be Closed in a timely manner to auto-reconcile WIP

Changing a Job from FINISHED to CLOSED (in Job Control Panel - Close Jobs screen) is a required step to auto-reconcile your Work in Process account. When the job is closed, any difference between total job receipt output costs and actual job input costs is posted to your WIP Adjustments account. A common mistake customers make is to not Close jobs that have large variance values. The WIP Adjustment postings are required to balance you your overall cost of sales. You must always Close Jobs and you should aspire to closing Jobs as close to your Finish date as possible.