Overview

The Cost of Sales section in your general ledger must be structured to accommodate absorption costing. All your direct labor cost accounts must be Cost of Sales accounts offset by an Absorbed Labor contra-account. All your manufacturing overhead cost accounts must be Cost of Sales accounts offset by an Absorbed Mfg Overhead contra-account.

How are labor and overhead costs handled in a manufacturing company?

Labor and manufacturing overhead costing is handled completely differently in a manufacturing chart of accounts than in a generic chart of accounts.

Generic Chart of Accounts

In a generic chart of accounts, labor and manufacturing overhead costs are handled by Expense accounts and shop expenses are often blended with general expenses. For example, payroll expenses for shop and office employees are often lumped together into shared expense accounts. Shop and office expenses for rent, utilities, insurance, maintenance, utilities and other costs are often lumped into shared expense accounts.

Manufacturing Chart of Accounts

By contrast, in a manufacturing chart of accounts, labor and manufacturing overhead costs are handled by Cost of Sales accounts. Shop-related costs are isolated from general and administrative costs. Job labor and manufacturing overhead transactions post to contra-accounts that offset actual costs and thus “absorb” labor and overhead costs into the inventory costs of the items you make.

You must restructure your labor and overhead accounts

To use your chart of accounts with financial transfer processes, you must restructure your direct labor and manufacturing overhead accounts to convert your generic chart of accounts into a manufacturing chart of accounts. See below for detailed instructions.

You must restructure your payroll account assignments

After you restructure your direct labor and manufacturing overhead accounts, you must change your payroll system account assignments so that production worker costs are posted to direct labor accounts and shop management and non-production worker costs are posted to manufacturing overhead accounts. See below for detailed instructions.

Add Absorbed Costs sub-sections to your Cost of Sales

Add the following Absorbed Costs sub-sections at the end of your Cost of Sales section.

Cost of Sales - Absorbed Labor Costs

What are direct labor costs?

Direct labor costs are the actual payroll costs associated with production worker employees, including benefits, taxes, and wages, as well as their share of workmans compensation insurance. Contract worker costs are also direct labor costs.

NOTE: Do not include payroll costs for manager, supervisor, shipping, receiving, warehouse, inspection, maintenance, and development employees, which are considered to be indirect labor costs.

Direct labor costs are absorbed into your inventory

DBA is an absorption costing system where direct labor costs are absorbed into the inventory cost of the items you make. Instead of treating direct labor costs as Expense accounts, they are treated as Cost of Sales accounts that are offset by an Absorbed Labor contra-account.

Actual costs establish your shop labor rate

Actual direct labor costs for a given period of time are periodically entered in the Shop Rates screen where they get divided by reported labor hours to calculate your overall shop rate for labor. The shop rate gets applied to your work center hourly rates, which provide the cost basis for the labor transactions that post to the Absorbed Labor contra-account. To make absorption costing work properly, it is vitally important that you isolate your direct labor costs in the Cost of Sales section of your chart of accounts.

Create an Absorbed Labor set of accounts

Isolate your direct labor cost accounts and locate them in a new Absorbed Labor sub-section of your Cost of Sales. Here is the Absorbed Labor set of accounts in the DBA chart of accounts Cost of Sales section, which you can use as a guideline:

54000 Absorbed Labor

54100 Labor Payroll - Benefits

54200 Labor Payroll - Taxes

54300 Labor Payroll - Wages

54400 Labor Payroll - Workmans Comp

54400 Contract Labor

Let’s now review each of these accounts and how it is set up:

Absorbed Labor

Create this new account and locate it at the beginning of your direct labor sub-section. All job labor transactions credit this account, which is a contra-account that offsets the debit transactions associated with actual direct labor costs.

Labor Payroll - Benefits, Wages, Taxes

In your payroll system, isolate payroll costs associated with your direct labor employees and post them to these accounts. In some payroll systems you can assign employees to groups and then assign cost accounts to the group. In QuickBooks payroll, you can use payroll items to represent payroll cost categories and assign cost accounts to those items.

Labor Payroll - Workmans Comp

When you pay your workmans compensation insurance, allocate a portion of it to cover the amount associated with your direct labor employees.

Contract Labor

If you hire contract labor, post those costs to this account.

Cost of Sales - Absorbed Subcontract Cost

Absorbed Subcontract Cost

Create this new account and locate it after your Absorbed Labor sub-section.

Cost of Sales - Absorbed Misc Cost

Absorbed Misc Cost

Create this new account and locate it after your Absorbed Subcontract Cost account.

Cost of Sales - Absorbed Mfg Overhead Costs

What is manufacturing overhead?

Manufacturing overhead includes all the indirect costs associated with the manufacturing process, including the factory’s share of rent, utilities, maintenance, supplies, taxes, insurance, and depreciation, as well as payroll benefits, taxes, and wages for indirect labor, which includes shop manager, supervisor, shipping, receiving, warehouse, inspection, and maintenance employees.

NOTE: Manufacturing overhead should not include selling, general and administrative (SG&A) expenses.

Manufacturing overhead costs are absorbed into your inventory

DBA is an absorption costing system where manufacturing overhead costs are absorbed into the inventory cost of the items you make. Instead of treating direct manufacturing overhead costs as Expense accounts, they are treated as Cost of Sales accounts that are offset by an Absorbed Mfg Overhead contra-account.

Actual costs establish your shop overhead rate

Actual manufacturing overhead costs for a given period of time are periodically entered in the Shop Rates screen where they get divided by reported labor hours to calculate your overall shop rate for manufacturing overhead. The shop rate gets applied to your work center hourly rates, which provide the cost basis for the labor transactions that post to the Absorbed Mfg Overhead contra-account. To make absorption costing work properly, it is vitally important that you isolate your manufacturing overhead costs in the Cost of Sales section of your chart of accounts.

Create an Absorbed Mfg Overhead set of accounts

Isolate your manufacturing overhead cost accounts and locate them in a new Absorbed Mfg Overhead sub-section of your Cost of Sales following the Absorbed Misc Cost account. Here is the Absorbed Mfg Overhead set of accounts in the DBA chart of accounts Cost of Sales section, which you can use as a guideline:

57000 Absorbed Mfg Overhead

58000 Factory - Depreciation - Equipment

58100 Factory - Depreciation - Vehicles

58200 Factory - Depreciation - Buildings

58300 Factory - Insurance - Other

58350 Factory - Insurance - Vehicles

58400 Factory - Leases

58500 Factory - Maintenance

58600 Factory - Property Taxes

58700 Factory - Rent

58800 Factory - Supplies and Expenses

58900 Factory - Utilities

59000 Indirect Payroll - Benefits

59100 Indirect Payroll - Taxes

59200 Indirect Payroll - Wages

59300 Indirect Payroll – Workmans Comp

Let’s now review each of these accounts and how it is set up:

Absorbed Mfg Overhead

Create this new account and locate it at the beginning of your manufacturing overhead sub-section. All job labor transactions credit this account, which is a contra-account that offsets the debit transactions associated with actual manufacturing overhead costs.

Factory - Depreciation - Equipment, Vehicles, Buildings

All depreciation costs related to the factory should be posted to these accounts.

Factory - Insurance - Other, Vehicles

All insurance costs or portions of insurance bills related to the factory should be posted to these accounts.

Factory - Leases

All leasing costs related to the factory should be posted to this account.

Factory - Maintenance

All factory maintenance costs should be posted to this account.

Factory - Property Taxes

A portion of your property tax bills should be allocated to cover the factory’s share of property tax cost.

Factory - Rent

A portion of rent cost should be allocated to cover the factory’s share of rent cost.

Factory - Supplies and Expenses

Factory-related supplies and expenses should be posted to this account.

Factory - Utilities

A portion of utility bills should be allocated to cover the factory’s share of utility costs.

Indirect Payroll - Benefits, Taxes, Wages

In your payroll system, isolate payroll costs associated with your indirect manufacturing labor (shop management, shop supervisors, and shipping, receiving, warehouse, inspection, and maintenance personnel) and post them to these accounts. In some payroll systems you can assign employees to groups and then assign cost accounts to the group. In QuickBooks payroll, you can use payroll items to represent payroll cost categories and assign cost accounts to those items.

Indirect Payroll - Workmans Comp

When you pay your workmans compensation insurance, allocate a portion of it to cover the portion associated with your indirect labor employees.

Inactivate labor and overhead Expense accounts

In your chart of accounts, inactivate any labor and manufacturing Expense accounts that were replaced by the new Cost of Sales accounts set up above.

Cross-reference your accounts

After your labor and overhead accounts are finalized, you must cross-reference each of your account numbers with the corresponding account in the DBA chart of accounts. This enables the GL Summary Transfer screen to post DBA account totals to the appropriate accounts in your general ledger.

To do so, go to the GL – General Ledger Setup - Chart of Accounts screen and on the Detail tab select each DBA account and enter your corresponding account number in the X-Ref Account field.

Start posting to the new Cost of Sales accounts

Even if you have not yet activated the DBA system for live use, start posting your direct labor and manufacturing overhead costs to the new Cost of Sales accounts.

Income Statement Example

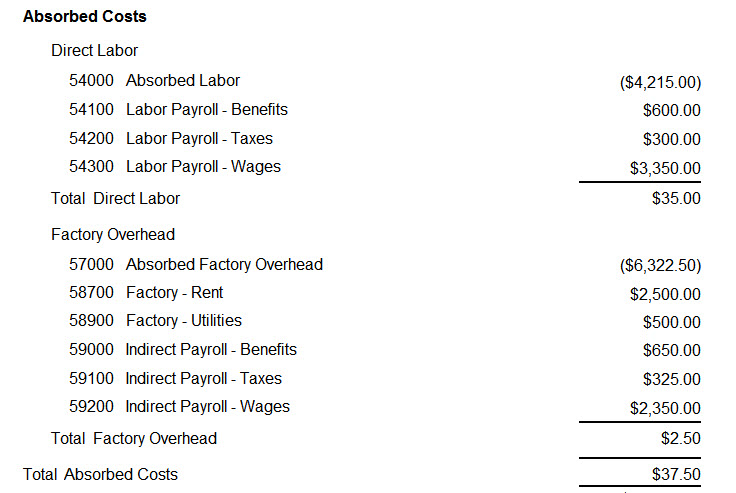

It may help you conceptualize how absorption costing works by viewing the following sample income statement. Keep in mind that this is sample data, which does not include as many actual costs as would be listed in a real company, but it illustrates how absorbed costs and actual costs roughly offset each other.

Take note that the credit amount for the Absorbed Labor account is roughly offset by the actual direct labor cost debit amounts.

Take note that the credit amount for the Absorbed Mfg Overhead account is roughly offset by the actual manufacturing overhead cost debit amounts.

Direct Labor Section

Take note of the Direct Labor section of the income statement. Job labor costs within this date range are posted to the Absorbed Labor account based on the shop labor rate applied to work center hourly rates. The objective of the hourly shop labor rate is for total Absorbed Labor to roughly offset the adjacent actual direct labor cost accounts, which neutralizes any effect on cost of sales. Job labor costs get absorbed into item inventory values with job receipts and ultimately affect cost of sales through cost of goods sold when items are invoiced.

Factory Overhead Section

Take note of the Factory Overhead section of the income statement. Job overhead costs within this date range are posted to the Absorbed Factory Overhead account based on the shop overhead rate applied to work center hourly rates. The objective of the hourly shop overhead rate is for Absorbed Mfg Overhead to roughly offset the adjacent actual overhead cost accounts, which neutralizes any effect on cost of sales. Job overhead costs get absorbed into item inventory values with job receipts and ultimately affect cost of sales through cost of goods sold when items are invoiced.