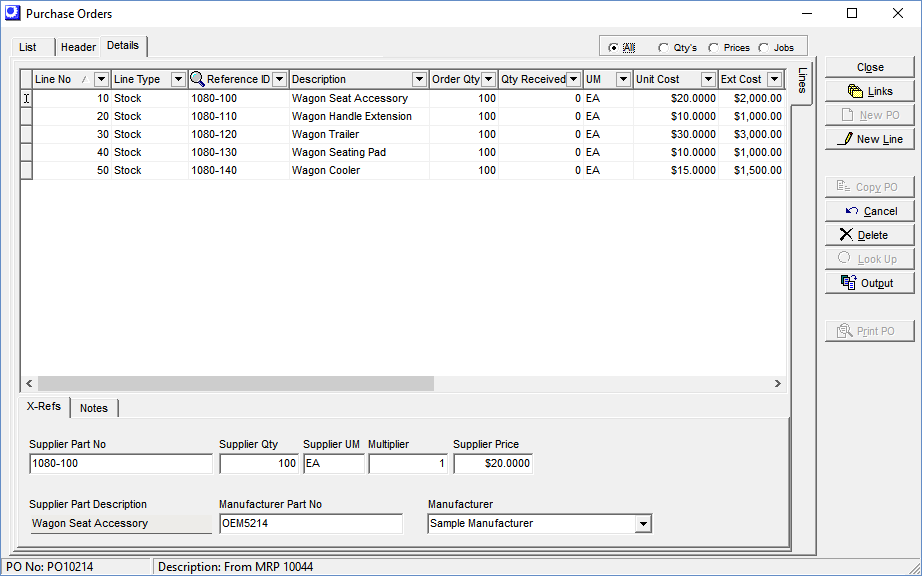

(Purch – Purchase Orders - Details Tab)

PO lines are modified or entered from scratch on this screen.

Screen Details

Upper Grid

Line No

As each line is created, it gets assigned a sequential line number in increments of ‘10’. This identifies the line and controls the sort order on the printed PO.

Line Type

From the drop-down list you can select ‘Stock’ to enter a stock item and ‘Descriptor’ to enter a descriptor. When the PO line was generated for a subcontract service in the Job Subcontracting screen, ‘SUBCON’ displays in this field.

Reference ID

This is the stock Item ID or Descriptor ID. In the case of subcontract services, this is the text “Service – ” followed by the Item ID of the item being serviced.

Link:

Description

The Description from the stock item or descriptor master record is displayed. IN the case of subcontract services, the Description from the originating job line is displayed.

NOTE: You can modify the description, if you wish. This capability is most commonly used with descriptors where the descriptor represents a general category of purchases. On each particular purchase you type in the description for the specific item you are buying.

Order Qty

This is the quantity being ordered, expressed in the item’s stocking unit of measure or the descriptor’s unit of measure.

Qty Received

This read-only field displays the quantity received to-date.

UM

This is the item’s stocking unit of measure or the descriptor’s unit of measure.

Unit Cost

This is the unit cost of this line item that, when received, is used to update the item’s Inventory Cost (in the case of stock items) or the job line’s Act Cost (in the case of descriptors or subcontract service lines with Subcon Job values). The unit cost derives from four possible sources:

| • | If a supplier price is maintained in the Item - Sources - Suppliers tab for this line item/supplier combination, that price is used as the Supplier Price (see below), which is then translated by the Multiplier and Exchange Rate (if applicable) to establish the Unit Cost. |

| • | If a supplier price is not found and the line item is a stock item, the item’s Last Cost is used as the Unit Cost. |

| • | If a supplier price is not found and the item is a descriptor, the descriptor’s Estimated Cost is used as the Unit Cost. |

| • | In the case of subcontract services, the Supp Price in the job subcontract routing sequence gets passed into the Supplier Price field (see below), which is then translated by the Multiplier and Exchange Rate (if applicable) to establish the Unit Cost. |

Ext Cost

This read-only field is the result of the Order Qty multiplied by the Unit Cost.

Total Tax

This field displays the purchase tax total for this line item. It is calculated by applying the Tax Rate percentage associated with the Tax Code at right to the total price. You can manually override this amount, if you wish.

Non-Taxable Lines

If an item or descriptor is always non-taxable, regardless of supplier, a non-taxable tax code Exception should be assigned against the stock item or descriptor. A non-taxable Tax Code has a zero percentage tax rate.

Tax Source

This field value indicates the source of the Tax Code at right. There are five possible values:

Header

The Tax Code at right is the Tax Code from the purchase order Header tab.

Item

The Tax Code at right is a tax code Exception designated in the stock item master record.

Descriptor

The Tax Code at right is a tax code Exception designated in the descriptor master record.

Tax Matrix

The Tax Code at right derives from the Tax Group Matrix and is determined by the Tax Group associated with the supplier master record combined with the Tax Group associated with the item or descriptor master record.

Manual

The Tax Code at right was selected manually from the lookup.

Tax Code

Each line item is assigned to a Tax Code, which gets its default value from the Tax Source indicated at left. You can manually select a tax code exception from the lookup.

NOTE: A Tax Code can be taxable or non-taxable. A non-taxable Tax Code has a zero percentage tax rate.

Due Date

When entering a new line, this is forward scheduled from the current date by the item’s Lead Days allocation, rounded forward to the nearest shop day. We recommend that all POs be generated via MRP and the Due Dates are set based on the Lead Days allocation. It is not recommended to future schedule your PO Due Dates as this can disrupt the alignment of your schedule.

Schedule Impact: The PO line Expected Date is set equal to the Due Date at line creation. The PO Expected Date represents the projected supply date of that item. You can manage an update your Expected Date in the PO Schedule screen.

Subcon Job

If this PO line was generated from the Job Subcontracting screen, this identifies the job to which it is linked.

Sequence

If this PO line was generated from the Job Subcontracting screen, this identifies the job routing sequence to which it is linked.

Line Status

The line status changes from ‘Open’ to ‘Closed’ when the Final Receipt checkbox is selected in the PO Receipts screen and the receipt quantity is fully matched in the PO Invoices screen. If you wish to reopen the line to receive an additional quantity, click the down arrow and the status will change from ‘Closed’ to ‘Open’.

X-Refs Sub-Tab

Supplier Part No

This is the Reference ID that prints on the PO. When the item has a Supplier Part No maintained on the Sources tab of the Stock Items screen for this supplier, it displays in this field. If not, the line’s Reference ID in the upper grid is copied into this field. You can manually override this field, if you wish.

Supplier Description

This is the Description that prints on the PO. When the item has a Supplier Description maintained on the Sources tab of the Stock Items screen for this item, it displays in this field. If not, the item’s standard description is displayed.

Supplier Qty

It is not uncommon for a supplier to sell an item in a different unit of measure than the item’s stocking unit of measure. The Supplier Qty is multiplied by the Multiplier value to establish the Order Qty. Conversely, the Order Qty is divided by the Multiplier to establish the Supplier Qty. So if you change the quantity in this field, it changes the Order Qty, and vice-versa.

NOTE: The Supplier Qty is the Qty that prints on the PO. The actual Order Qty also prints in a cross-reference section underneath the Reference ID.

Supplier UM

This is the UM that prints on the PO. If the item has a UM maintained in its Sources tab of the Stock Items screen for this supplier, it will display in this field. If not, this line item’s UM from the grid above copies into this field. You can manually override this entry, if you wish.

Multiplier

The Supplier Qty is multiplied by this factor to establish the Order Qty in the grid above. If the item has a Multiplier maintained in the Sources tab of the Stock Items screen for this supplier, it displays in this field. If not, this field is automatically assigned a value of ‘1’. You can manually override this amount, if you wish.

Supplier Price

If a record exists in the Purchase Prices – Items screen for this item, that price is pulled into this field. The Supplier Price is then translated into the Unit Cost value, using this formula:

Supplier Price * Multiplier = Unit Cost

If this PO is being submitted to the supplier in a foreign currency, the formula is this:

Price * Multiplier / Exchange Rate = Unit Cost

Currency Panel

This panel is only visible when the supplier is assigned to a foreign currency. It displays the currency code and description, the exchange rate (foreign units per unit of home currency), and the inverse exchange rate (units of home currency per unit of foreign currency). The exchange rate is assigned to the purchase order based on the Currency Table exchange rate in effect at time of purchase order creation and remains fixed for the duration of the purchase order.

Link:

Financial Transfer Guide - Multi-Currency

Financial Transfer Guide - Multi-Currency

If you are using the Legacy Financials accounting configuration:

If you are using the Legacy Financials accounting configuration, be aware that the legacy financial modules --Accounts Receivable, Accounts Payable, and Banking – have no multi-currency capabilities. For multi-currency processing you must convert to the Financial Transfer accounting configuration and a mainstream accounting package for financial processes (receivables, payables, banking, payroll, overall general ledger).

Link:

Legacy Financials Conversion Guide

Legacy Financials Conversion Guide

Mfgr Part No

This read-only field is only visible on stock items and prints on the PO. It displays the Mfgr Part No assigned to this Manufacturer for this item.

Manufacturer

When a new line is created, the item’s Default Manufacturer is inserted into this field. You can select an alternate Manufacturer from the lookup, if you wish.

Notes Sub-Tab

PO line notes print on the PO and originate from these sources:

| • | When a PO line is generated by MRP or created manually, the SO/PO Notes stored against the item or descriptor master record are transferred into this notes field. |

| • | When a PO line is generated from the Job Subcontracting screen, the Line Notes from the originating job detail line are transferred into this notes field. |

New Line Button

Click this button to open a new line in the upper grid. The Line No increments by a value of ‘10’ over the highest existing Line No and the Line Type defaults to the setting specified in the Admin – System Defaults screen.